What should early-stage startups do — and avoid — when building IP strategy

Let’s talk about the basics — What should a (still) young and (still) small startup do regarding its intellectual property? And on the flip side — what it should not do?

Let’s think together, and do some math here:

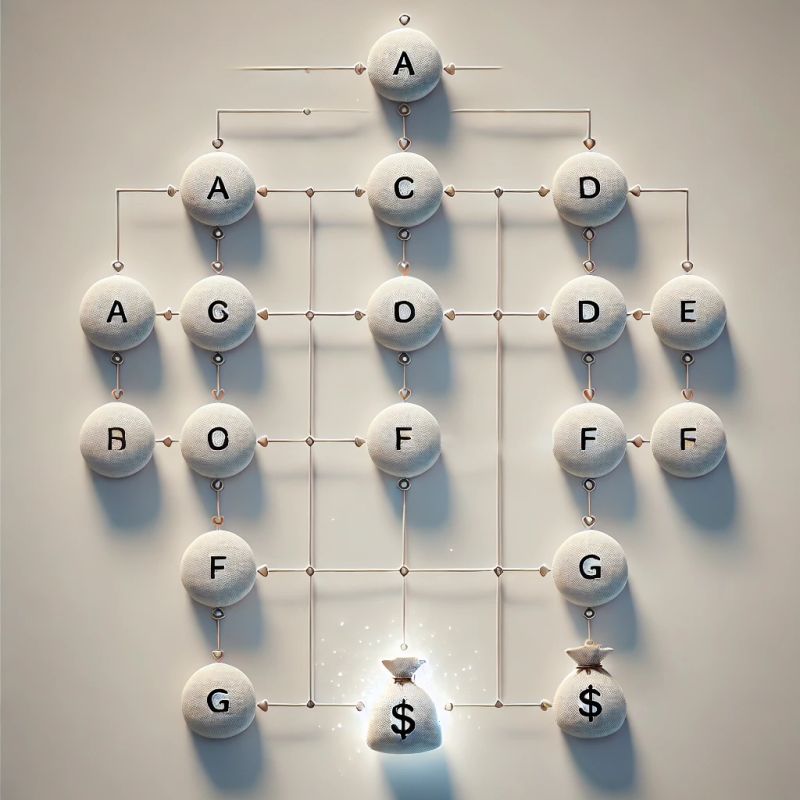

First equation: A (What do you know?) minus B (What do you know that anyone else doesn’t know?) equals C (Your unique advantage). If C exists, and has commercial utility, congratulations — C is your IP.

Second equation: D (The cost of doing things the old-fashioned way) minus the cost of performing C equals E (The financial gain by using C instead of D). If E is positive, congratulations — E is the financial value of C.

Third equation: E minus F (The cost of obtaining enforceable Patent protection for C) equals G. If G is positive, congratulations — C should be your first/next Patent. However, if G is negative, also congratulations — C should be your first/next Trade Secret.

Of course, no one actually solves these equations in real life. At least, not as actual equations. But the rational stands, and A to G should be defined and kept in-house (their values are Trade Secrets on their own).

I have solved these equations many times, for many clients. Contact me if you need some guidance.

✅ Do’s:

- Define your unique advantage (C): Identify what you know that others don’t, and confirm it has commercial value.

- Estimate the financial value (E): Calculate the gain from using your innovation versus the old way of doing things.

- Run the patent-vs-trade secret equation (G): If patenting costs less than the value it brings — patent it. If not — keep it as a trade secret.

- Document this logic internally: Even if it’s informal, define A to G and treat the values as confidential company knowledge.

- Use this framework to guide IP decisions: Let business value drive your IP actions, not just legal instincts.

❌ Don’ts:

- Don’t patent just because you can: Only do it when the value outweighs the cost.

- Don’t treat IP as an afterthought: It’s a core business asset, not a legal decoration.

- Don’t skip the math: You don’t need a spreadsheet, but you do need clarity on value vs. cost.

- Don’t ignore trade secrets: If patents aren’t worth it, trade secrets are often the smarter move.

How should early-stage startups approach IP strategy?

-

Your IP = What you uniquely know that others don’t, and can be commercialized.

-

The financial value of IP = Savings or gains it creates vs. the old way.

-

If protection costs less than the value it creates → patent. If not → trade secret.

-

Don’t skip the math — even if it’s back-of-the-envelope. That’s your edge.

Timing: Filing a Provisional Patent Too Early Can Backfire

Many early-stage startups rush to file provisional patent applications the moment they have a breakthrough idea.

But here’s the problem: A dream isn’t enough. Even if it’s a bold, disruptive, world-changing dream.

“I have a dream,” said Martin Luther King — but he didn’t try to patent it. And neither should you.

A provisional patent application isn’t a placeholder for ambition. It’s supposed to reflect a real, reproducible, enabling disclosure — not just a vision, wish list, or napkin sketch.

❌ When filing a patent too early:

- You waste resources on filings that won’t hold up in court.

- You risk exposing your ideas before they’re ready.

- You create a false sense of security while competitors keep innovating.

✅ What should you do instead?

- Focus first on reducing your idea to practice — even if only at the conceptual or prototype level.

- Document real technical progress and innovation.

- File only when your provisional will actually support future rights.

Remember: Strong IP protects innovation — but rushed IP can leave it exposed and ultimately unprotectable. Even MLK had a dream, not a filing date…

What’s the risk in filing a provisional patent application too early, before your idea is fully developed?

- Filing too early creates weak protection, wastes resources, and gives false confidence

- A dream or vision isn’t enough — you need reproducible, technical disclosure

- File only when the invention is real enough to support enforceable rights

Why Long-Term IP Strategy Partnerships Beat Last-Minute Legal Fixes

Here’s something most startups learn the hard way: treating IP strategy as a transaction rather than a relationship is like trying to build a house by only calling contractors when something breaks.

Let’s face it: the relationship between an IP advisor and an innovative startup is not unlike a slow-burning romantic comedy.

There’s curiosity. There’s hesitation. There’s “We’re not ready for commitment just yet.” And of course, the inevitable, “Where were you six months ago when we rushed into filing that provisional?”

But when we skip the awkward miscommunications and build real trust early on, something powerful happens. Startups don’t just get “legal coverage.” They get an unfair advantage:

- They avoid costly mistakes (like filing too early, too broadly, or for the wrong thing entirely)

- They gain clarity: IP becomes a strategic tool, not a mystery wrapped in jargon

- They strengthen their position with investors, partners, and future acquirers

- They align their R&D efforts with long-term defensibility – not short-term guesswork

- They develop confidence in every funding round, term

Meanwhile, the IP advisor gets the privilege of translating their hard work into something that can stand up to due diligence, protect market share, and actually hold value.

Think of it as transforming “cool tech” into a scalable business asset. It’s not about filing more patents. It’s about filing the right ones — smartly, strategically, and at the right time.

When the startup is ready to let me in – not just at the tail-end of a rushed deadline, but as a thought partner – we turn reactive chaos into proactive strength.

The result? Stronger companies. Smarter portfolios. Less stress. More value.

So here’s to the courtship. The long-term relationships. The ones where innovation and IP strategy grow up together.

Let’s build something that lasts.

Conclusion: Why startups need IP advisors early — not just before deadlines

-

Early collaboration turns IP from legal clutter into strategic leverage.

-

The right advisor helps avoid premature filings, aligns R&D with defensibility, and builds investor-ready assets.

-

IP works best when it’s a long-term relationship, not a last-minute fix.

When you combine strategic thinking with proper timing and genuine partnership, IP becomes what it should be: not just legal protection, but a competitive advantage that grows with your company. That’s when the magic happens — when founders look at their IP portfolio and say, “Wow. That’s actually kind of beautiful.”